Home

| About

| Mine Tracker

| RSS

| Footer

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ █▄▄░▄▄█░▄▄▀█░▄▄▀█▀▄▀█░▄▄███░▄▄▀█░▄▄▀█░▄▀███▄▄░▄▄█░▄▄▀█░▄▄▀█▀▄▀█░▄▄█░▄▄▀█░▄▄▀██▄██░███▄██▄░▄█░██░ ███░███░▀▀▄█░▀▀░█░█▀█░▄▄███░▀▀░█░██░█░█░█████░███░▀▀▄█░▀▀░█░█▀█░▄▄█░▀▀░█░▄▄▀██░▄█░███░▄██░██░▀▀░ ███░███▄█▄▄█▄██▄██▄██▄▄▄███▄██▄█▄██▄█▄▄██████░███▄█▄▄█▄██▄██▄██▄▄▄█▄██▄█▄▄▄▄█▄▄▄█▄▄█▄▄▄██▄██▀▀▀▄ ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Paper; Monitoring Global Supply Chains

https://dash.harvard.edu/bitstream/handle/1/11591700/short%252ctoffel%252chugill_monitoring-global-supply-chains.pdf

Firms seeking to avoid reputational spillovers that can arise from dangerous, illegal, and unethical behavior at supply chain factories are increasingly relying on private social auditors to provide strategic information about suppliers’ conduct. But little is known about what influences auditors’ ability to identify and report problems. Our analysis of nearly 17,000 supplier audits reveals that auditors report fewer violations when individual auditors have audited the factory before, when audit teams are less experienced or less trained, when audit teams are all-male, and when audits are paid for by the audited supplier. This first comprehensive and systematic analysis of supply chain monitoring identifies previously overlooked transaction costs and suggests strategies to develop governance structures to mitigate reputational risks by reducing information asymmetries in supply chains.

https://dash.harvard.edu/bitstream/handle/1/11591700/short%252ctoffel%252chugill_monitoring-global-supply-chains.pdf

Firms seeking to avoid reputational spillovers that can arise from dangerous, illegal, and unethical behavior at supply chain factories are increasingly relying on private social auditors to provide strategic information about suppliers’ conduct. But little is known about what influences auditors’ ability to identify and report problems. Our analysis of nearly 17,000 supplier audits reveals that auditors report fewer violations when individual auditors have audited the factory before, when audit teams are less experienced or less trained, when audit teams are all-male, and when audits are paid for by the audited supplier. This first comprehensive and systematic analysis of supply chain monitoring identifies previously overlooked transaction costs and suggests strategies to develop governance structures to mitigate reputational risks by reducing information asymmetries in supply chains.

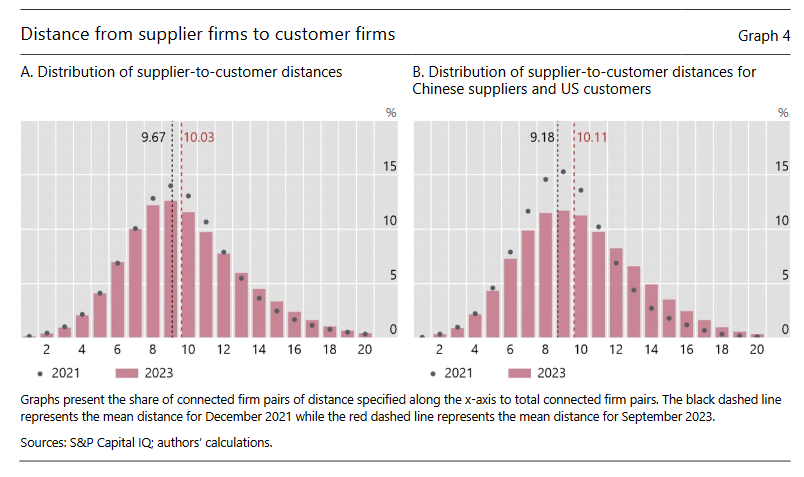

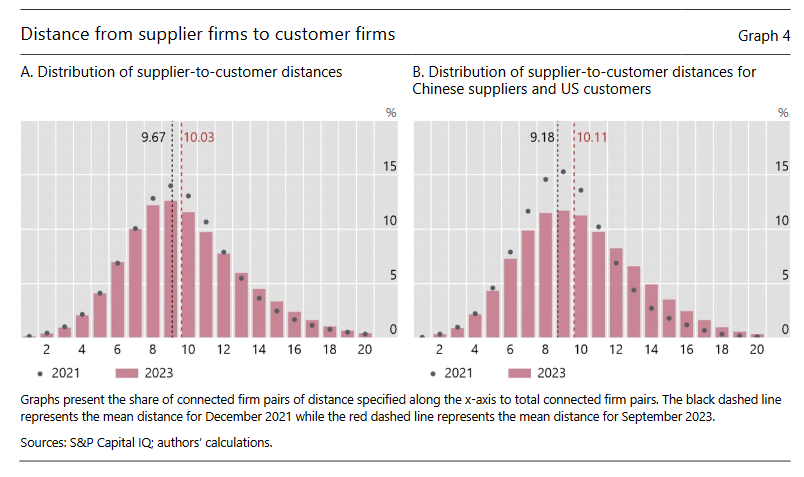

Paper; Mapping the realignment of global value chains

https://www.bis.org/publ/bisbull78.htm

The latest firm-level network data reveal that global value chains have lengthened, although without the accompanying network densification that might indicate that supplier relationships are diversifying. Lengthening of supply chains is especially significant for supplier-customer linkages from China to the United States, where firms from other jurisdictions, notably in Asia, have interposed themselves in the supply chain. Nevertheless, these recent developments have not so far reversed the long-running trend toward greater regional integration of trade in recent decades, especially in Asia.

https://www.bis.org/publ/bisbull78.htm

We assume the temporal is permanent

https://en.wikipedia.org/wiki/The_Economic_Consequences_of_the_Peace

https://en.wikipedia.org/wiki/The_Economic_Consequences_of_the_Peace

The power to become habituated to his surroundings is a marked characteristic of mankind. Very few of us realize with conviction the intensely unusual, unstable, complicated, unreliable, temporary nature of the economic organization by which Western Europe has lived for the last half century. We assume some of the most peculiar and temporary of our late advantages as natural, permanent, and to be depended on, and we lay our plans accordingly. On this sandy and false foundation we scheme for social improvement and dress our political platforms, pursue our animosities and particular ambitions, and feel ourselves with enough margin in hand to foster, not assuage, civil conflict in the European family.This is how Maynard Keynes' The Economic Consequences of Peace (1919) starts. After more than a 100 years this seems a good place to start in our own analysis of our current complacency about the inevitablity, reliability and security of global supply chains that structure our trade, economic, political and social environment today.

Dell Theory of Conflict Prevention

https://en.wikipedia.org/wiki/The_World_Is_Flat

A divine peace of wisdom from Thomas Friedman's The Word is Flat (2005). The Argument predates the first word war.

https://en.wikipedia.org/wiki/The_World_Is_Flat

A divine peace of wisdom from Thomas Friedman's The Word is Flat (2005). The Argument predates the first word war.

Book: The World for Sale

https://books.google.nl/books?id=ia8gEAAAQBAJ

The modern world is built on commodities - from the oil that fuels our cars to the metals that power our smartphones. We rarely stop to consider where they have come from. But we should. In The World for Sale, two leading journalists lift the lid on one of the least scrutinised corners of the world economy: the workings of the billionaire commodity traders who buy, hoard and sell the earth's resources. It is the story of how a handful of swashbuckling businessmen became indispensable cogs in global markets: enabling an enormous expansion in international trade, and connecting resource-rich countries - no matter how corrupt or war-torn - with the world's financial centres.

https://books.google.nl/books?id=ia8gEAAAQBAJ

The modern world is built on commodities - from the oil that fuels our cars to the metals that power our smartphones. We rarely stop to consider where they have come from. But we should. In The World for Sale, two leading journalists lift the lid on one of the least scrutinised corners of the world economy: the workings of the billionaire commodity traders who buy, hoard and sell the earth's resources. It is the story of how a handful of swashbuckling businessmen became indispensable cogs in global markets: enabling an enormous expansion in international trade, and connecting resource-rich countries - no matter how corrupt or war-torn - with the world's financial centres.